How Much Home Can You Afford?

Buying a home is an exciting time, filled with many positive emotions (No more rent!) and other anxious feelings (Can we really afford this?). While the roller coaster of thoughts can often make you feel exhausted, there is a way to take the edge off. By knowing exactly how much home you can afford, you’ll be able to tour homes in your price range confidently, and avoid any buyer’s remorse later on. Here’s how to determine what mortgage payment is right for you.

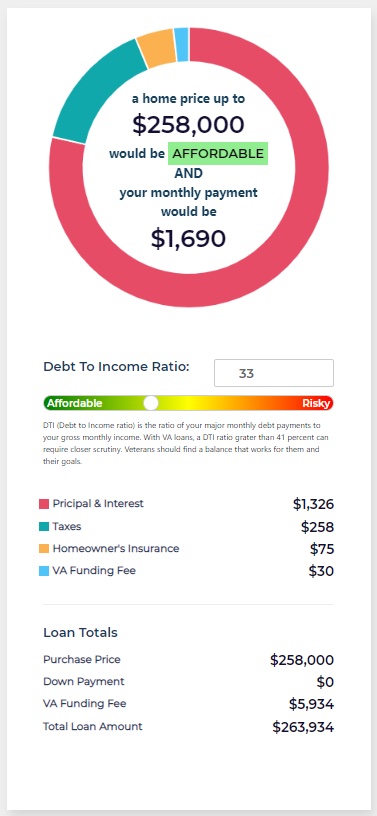

VA Home Loan Affordability and Payment Calculator

The MHS VA home loan calculator is a great way to estimate the price point of a house you can afford comfortably. While you may get pre-approved for $500,000, you might only be able to swing a $375,000 mortgage payment. Using our calculator, you will input your location, annual income, monthly debts, down payment amount, credit score, estimated interest rate, military type, and disability percentage.

From there, the calculator will show you what dollar amount you can afford for a home and what that monthly payment would look like. Unlike other mortgage calculators, ours is designed for those seeking VA loans which is why we factor in things like a VA funding fee. Our calculator also shows you your debt-to-income (DTI) ratio and how your ratio ranks on a scale of “affordable” to “risky.”

Keep reading for even more ways to determine what home price you can afford.

Calculating Your DTI

DTI stands for debt-to-income ratio. This ratio represents how much debt you have versus the income you make. To calculate your DTI, you will divide your monthly debt payments by your monthly gross income. The ratio is critical to know if you want to purchase a home as it tells lenders how well you manage your debt and how likely you are to repay loans.

Step 1: Add Up All Of Your Monthly Debts

Step 2: Divide Your Monthly Debts By Your Monthly Gross Income

For example, if your monthly debt equals $5,000 and your gross monthly income is $9,000, your DTI ratio is about 55% (5,000/9,000=0.55).

Quick note: Although the VA does not have any DTI requirements, most banks and lenders will require a DTI ratio of 60% or less.

The 29/41 Rule

When the team at MHS evaluates your mortgage application, we calculate your debt-to-income (DTI) ratio, just like our calculator does. We take all your monthly recurring debts (credit card, car, or personal loan payments) and divide them by your monthly gross income (from paychecks, investments, etc.) This ratio lets us know how much more debt you can reasonably take on.

The 29/41 rule can give you confidence in your financial wellness by ensuring that your mortgage payment is no more than 29% of your gross monthly income and your total monthly debt is no more than 41% of your total monthly income.

To calculate the top number (the 29), you can use this formula:

(Principal + Interest + Property Taxes + Insurance (Homeowners & Mortgage) + Homeowners Association Dues) × 100/ Gross Monthly Income

To calculate the bottom number (the 41), you can use this formula:

(Installment Debt + Revolving Debt Payments) × 100/ Gross Monthly Income

Although DTI ratios are allowed with VA loans, the 29/41 rule provides a good starting point.

Mortgage Interest Rate

Another major factor in determining the right mortgage payment for you is interest rates. In the last few years, we’ve seen historically low home loan rates, but they will continue to rise this year.

Even small changes in interest rates make a difference in affordability. Looking at the $258,000 home from earlier, the mortgage shifts dramatically based on interest changes alone. For example, the $258,000 home with 5% interest has a $1,750 mortgage payment, while the home with an 8% interest rate has a $2,269 mortgage payment. That’s over $500 per month.

5% interest

8% interest

Your Monthly Budget

Finally, once you've utilized our mortgage calculator, determined your DTI, reviewed the 29/41 rule, and looked over interest rates, it can be helpful to do some budget tracking. Record all of your transactions over a period of several months (excluding rent). Once you have all of your transactions, you can sort them into buckets—for example, groceries, entertainment, medical, recreational, and more. From there, add your estimated mortgage payment and see where you stand. Do you have money left at the end of the month? Can your current lifestyle handle a mortgage payment? If not, can you trim some expenses to accommodate that payment?

Quick tip: You may also want to move your estimated mortgage payment into monthly savings to simulate what it will feel like to have an actual mortgage payment.

Bottom Line

At MHS Lending, we are experts in working with military members and veterans, and therefore, we understand the specific ins and outs of military income. Some VA disability income and military allowances like Basic Allowance for Housing (BAH) are eligible to be counted when determining how much you can borrow with your VA Loan. BAH is a robust allowance that can be allocated to paying for some of, if not all, of your monthly mortgage payment.

If you’re curious if the type of military allowance you receive can be used for your VA Loan, contact us here.